Watch out for these wealth-eroding investment errors! Four of the most damaging myths that persist in Indian investing:

1. Allocating funds in investments such as gold in the erroneous belief that gold will help us protect our wealth.

‘If we consider returns from gold in each of the three decades separately over the last thirty years, we see that gold has underperformed the Sensex by a wide margin.’

2. Investing hard-earned money in real estate believing it will help you grow your wealth

‘ In the last five years, if one were to look at the return rate from real estate in metropolitan cities in India such as Mumbai, Delhi and Bengaluru, one would see that returns have been around 3–4 per cent per annum; i.e., house prices have at best kept pace with consumer inflation. ‘

3. Falling for the myth that debt mutual funds offer decent returns with low volatility

‘In spite of the repeated high-profile reverses suffered by prominent mutual fund houses who have high-risk, low-quality paper in their debt funds, the intermediary community continues to sell such products. ‘

4. Thinking you can time the stock market by timing the economic cycle, i can time the stock market on the belief that GDP growth drives the stock market!

‘More generally, across the world there tends to be low or no correlation between stock markets and GDP growth, implying that timing the stock market is not possible on a systematic basis.’

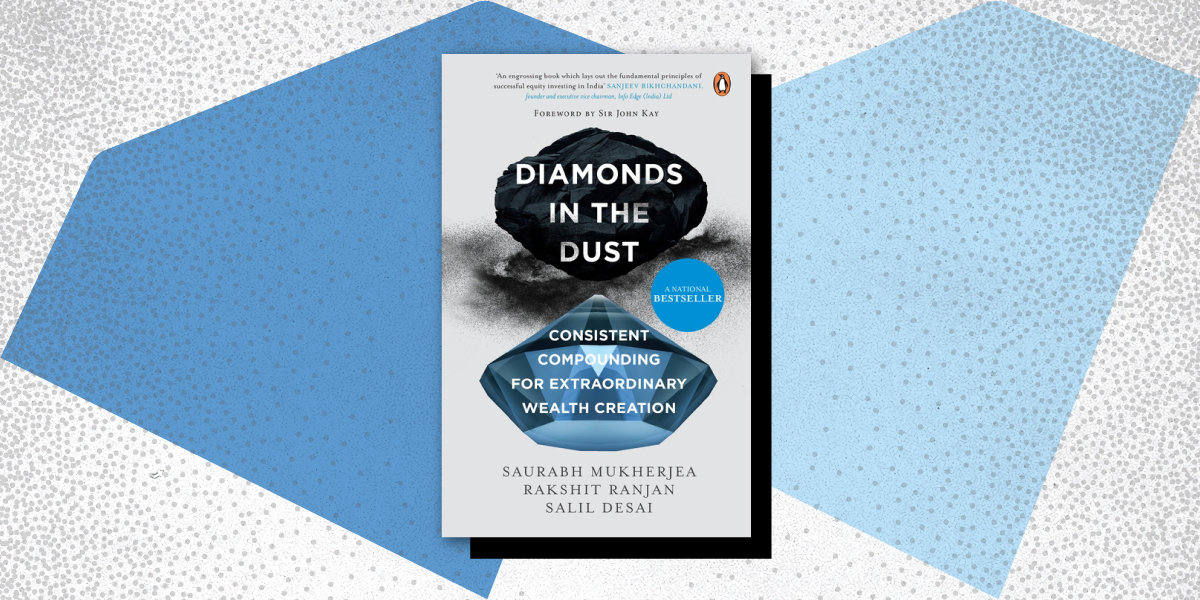

Did you just realize you’ve been making a few or all of these errors? Never fear, for the experts—-Saurabh Mukherjea, Rakshit Ranjan and Salil Desai, are here! Based on in-depth research conducted by the award-winning team at Marcellus Investment Managers, Diamonds in the Dust offers Indian savers a simple, yet highly effective, investment technique to identify clean, well-managed Indian companies that have consistently generated outsized returns for investors.