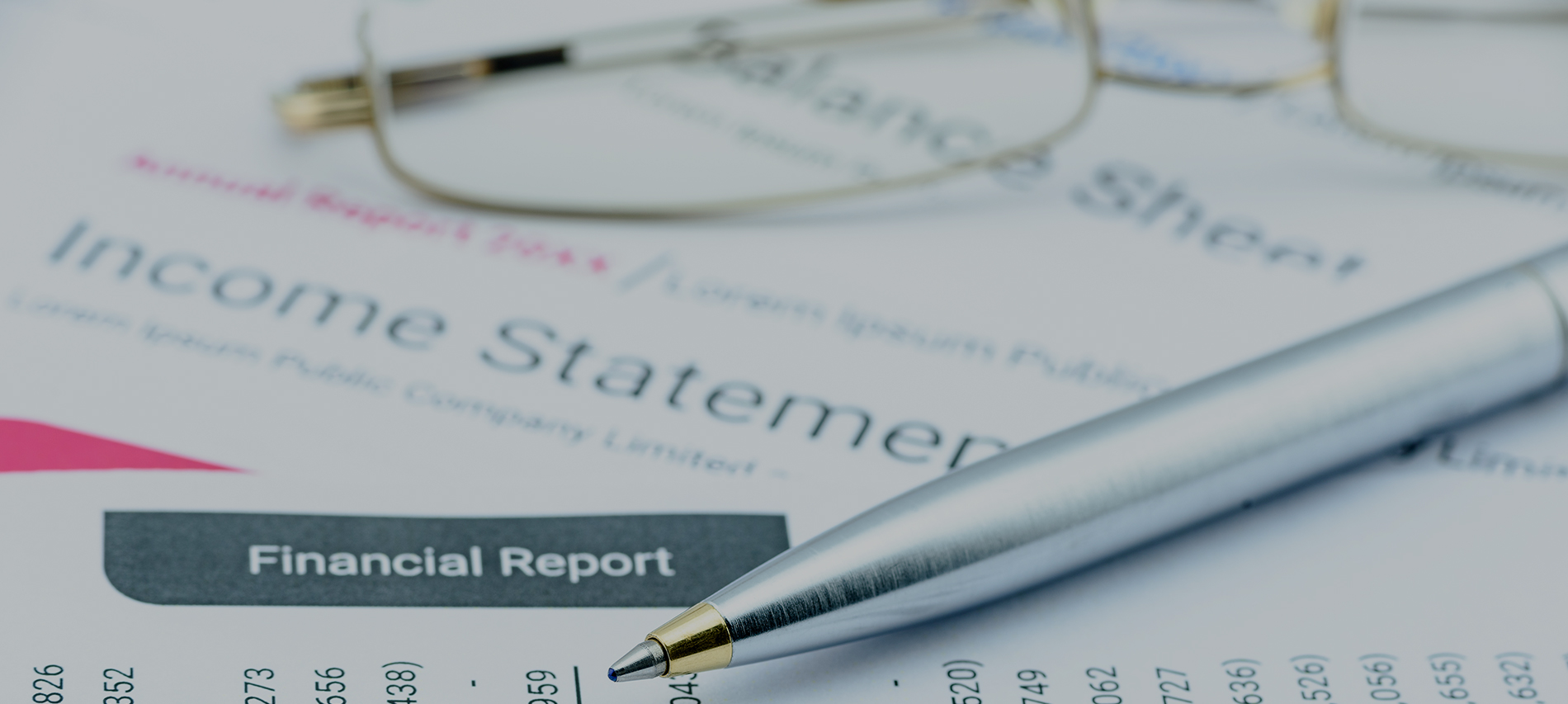

Tamal Bandyopadhyay is one of the most respected business journalists in India. He has had a ringside view of the major changes that came through in the Indian finance and banking sector in the last two decades. In his book ‘From Lehman to Demonetization’ he tells the epic story of banking in India in the last decade. The book features essays and interviews with stalwarts from the sector like Raghuram Rajan, Arundhati Bhattacharya, and many others.

Here is an excerpt from the book.

On the day US investment bank Lehman Brothers Holdings Inc. filed for bankruptcy, the chief executive officers of six large commercial banks assembled at a south Mumbai hotel to debate a topic close to every foreign banker’s heart: ‘Should India open up the financial sector?’ Y.V. Reddy, former RBI governor, widely known for his views against the opening up of the sector, had retired just ten days before the collapse.

His successor, D. Subbarao, former finance secretary, was to be the chief guest at the conference but he excused himself because he could not have expressed his views on the subject in his new role as RBI governor. Owing to the newsflash that morning, the mood at the conference was sombre and even the traditionally aggressive foreign bankers, who always blame the Indian banking regulator for keeping the doors closed, were restrained in their arguments. The beer tasted flat that evening, the food stale, and a few panellists, including ICICI Bank Ltd’s then managing director and CEO, K.V. Kamath, did not wait for the dinner and left immediately after the discussion was over.

The exposure of ICICI Bank, India’s largest private-sector lender, to Lehman Brothers was $83 million, less than 0.1 per cent of its consolidated balance sheet, but investors rushed to sell the bank’s stock and pulled it down by 15 per cent in the next few days as panic gripped the market. A few other banks, including State Bank of India (SBI) and Punjab National Bank, two large public-sector banks, had a small exposure to Lehman Brothers in various forms.

At a meeting with the executives of Lehman Brothers’ Indian arm and local banks, V. Leeladhar, then deputy governor of RBI, told the US investment bank to close all transactions with Indian banks within twenty-four hours. Lehman Brothers did so in forty-eight hours. It was running a non-banking financial company in India, but its entire capital was invested in government bonds and bank deposits; so the money was safe. Its broking arm, Lehman Brothers Securities Pvt. Ltd, housed in Ceejay House—hemmed in between the Arabian Sea and the glass-walled Atria shopping mall on Annie Besant Road in midtown Mumbai, the most expensive office space in the city—was taken over by Japan’s Nomura Holdings Inc. In October, Nomura also took over Lehman Brothers’ back office operations, which employed 2200 people, in Powai, a western suburb of Mumbai.

The panic did not last long. The global financial system had plunged into an unprecedented liquidity crunch after the Lehman collapse but India shrugged it off relatively easily. The GDP growth dropped to 3.5 per cent in the March 2009 quarter, but in the very next quarter, it rose to 5.9 per cent and by the September 2009 quarter, it bounced back to 9.3 per cent.

We all celebrated how resilient the Indian banking system was. A cautious and conservative regulator ring-fenced the Indian banks by not allowing them to take excessive risk.

However, we celebrated too early. The monetary policy and fiscal stimulus that followed after the collapse to ward off its impact led to a V-shaped recovery at that point, but it didn’t last long; seeds were sown for high inflation and bad assets. It took years to bottle the inflation genie but we are far from sorting out the problem of bad assets.

The first rate cut was announced on 20 October 2008, more than a month after the Lehman collapse and in the next six months, the policy rate was brought down from 9 per cent to 3.25 per cent (lower than the savings bank rate which was an administered rate then); the cash reserve ratio or the portion of deposits that banks keep with the RBI from 9 per cent to 5 per cent; and the floor for banks’ government bond holding from 25 to 24 per cent. Collectively, the cut in the reserve requirement and the opening of new refinance windows pumped Rs 5.6 trillion into the Indian financial system.